How to use working capital ratios for financial analysis

You might feel like your business is doing well. Profits are steady, and invoices are paid. But what happens if revenue dips next month? Can your business still manage wages, vendor payments, and routine costs?

That’s where working capital ratios come in. As a key part of financial analysis, they reveal how much short-term flexibility your business truly has, something a profit-and-loss statement alone can’t show. If you’re wondering how to calculate net working capital, we’ve got you covered.

Understanding Working Capital Ratios

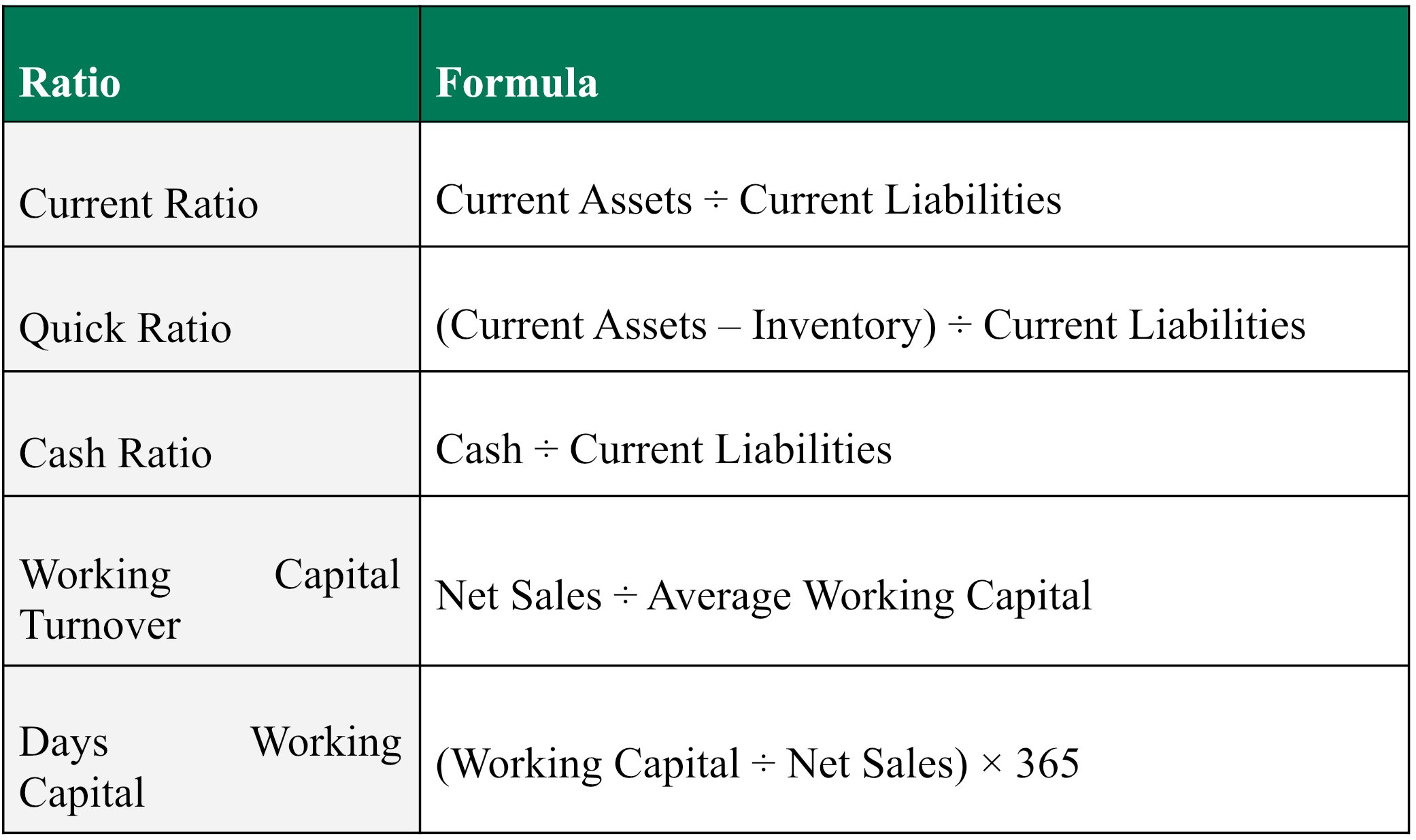

Working capital measures what a company has available after covering short-term obligations. So, what is that number? There, the ratios step in. They help you determine the extent to which your business is prepared to meet its short-term requirements, such as rent, payroll, or unexpected debts. These include:

They provide opposite lenses. Working in combination, these working capital ratios help you strengthen your financial analysis by a better understanding of your liquidity, inventory turnover, and capital effectiveness.

Key Working Capital Ratios and How to Calculate Them

When you understand what each ratio suggests, it will be easier to raise red flags, make sound decisions, and study the financial situation of a business. These are two examples:

Example 1: Retail Business

A clothing store has current assets of £195,000, inventory of £72,000, and liabilities of £90,000. The current ratio is 2.17. The quick ratio falls to 1.37 without inventory, highlighting limited liquidity without product sales.

Example 2: Cloud-based Business

A cloud-based startup with current assets of £285,000, minimal inventory, and liabilities of £95,000 has both a current and quick ratio of 3.0, indicating a strong cash cushion.

That is because these insights can either lead to stable growth or result in a cash crunch.

Interpreting Working Capital Ratios

Ratios become meaningful in context. What’s “healthy” depends on your industry, company size, and operations.

Amazon, for instance, has a low current ratio due to fast turnover and flexible supplier terms, unlike a manufacturer with slower cycles.

Deeper Ratio Insights

Certain ratios appear with greater precision. The quick ratio does not consider inventory and emphasises cash and receivables, which is critical when invoices become uncollected. The quick ratio and current ratio appear roughly the same in a SaaS business, as retailers are spread further apart.

The working capital turnover ratio brings out efficiency. A low number indicates that funds are tied up in stock or receivables, and a high number indicates lean operations with minimal protection. Frequent analysis of working capital facilitates the early detection of threats, as exemplified by a decline in the current ratio from 2.5 to 1.8.

Applying Ratios to Business Decisions

Working capital ratios inform daily business choices. Here’s how companies apply them:

Managing Cash Flow: A quick ratio below 1.0 suggests speeding up collections. A consulting firm might shorten payment terms or offer early payment discounts.

Inventory Strategy: There is a lot of stock when the turnover is low. Reevaluate reorder points or forecasts to reduce storage costs or obsolescence.

Vendor and Customer Terms: As receivables start increasing at a keener pace than payables, there are weaker cash flows. Strike favourable terms or modify customer credit policies.

Financing and Growth: Strong ratios signal discipline, appealing to lenders and investors. They also guide when to expand or pause plans.

Managing a growing business? Stay on top of working capital with Cash Flow Frog, built for small businesses→

Tools and Best Practices for Analysis

Manual tracking works early on, but larger businesses benefit from dedicated tools:

Cash Flow Frog: Helps monitor liquidity and plan ahead.

QuickBooks: Suits businesses that use it for accounting

Excel/Google Sheets: Flexible but time-consuming

Float: Simple forecasting for smaller teams

Still, tools alone aren't enough. To make working capital analysis effective, data must be reviewed regularly and used proactively.

Best practices include:

Monthly reviews

Seasonal comparisons

Setting internal targets

Insights should guide action, not sit in a report

Need a clearer view of your working capital? Be proactive using Cash Flow Frog’s forecasting tools →

Putting Ratios into Action

Working capital analysis draws a keener insight into the financial picture of businesses. These ratios assist in making wiser decisions, either in releasing a product, adapting to changes in the market, or scheduling the next quarter.

Have you applied working capital ratios in your company? We’d love to hear how they’ve helped.

Le Nusa is a modern Indonesian restaurant on the Strand in London, founded by an Indonesian celebrity couple. Originally launched in Paris before expanding to Jakarta, it brings refined Indonesian cuisine to the capital in an elegant two-floor setting…

Art news to be on your radar the first week of March 2026 comes from both London and across the globe. From Kahlil Joseph’s debut feature at London’s 180 Studios and Ain Bailey’s exhibition at Camden Art Centre, to the announcement of 111 artists for the Venice Biennale…

A review of Rose Wylie: The Picture Comes First at the Royal Academy of Arts, London examines the first solo exhibition by a British female artist in its main galleries, tracing Wylie’s use of memory, wartime imagery and everyday references across large-scale paintings and intimate drawings…

The 61st International Art Exhibition of La Biennale di Venezia, titled In Minor Keys, is set to open on Saturday, 9 May 2026, and run until Sunday, 22 November 2026. Curated by the late Koyo Kouoh, who passed away in May 2025, the exhibition will be staged across Venice’s Giardini, the Arsenale…

As March arrives in London, the city begins to shake off the winter chill with plenty to see and do. Food lovers can enjoy British Pie Week, while families can mark World Book Day at Battersea Power Station. There will be major exhibition openings, including Hurvin Anderson, David Hockney and a celebration of designer Elsa Schiaparelli…Here is our guide to things to do in London in March 2026…

In a digital economy increasingly defined by automation, optimisation, and seamless systems, Xiyan Chen creates worlds that refuse to work alone. Her practice does not ask what technology can do faster or better…

This week in art, there’s plenty to get excited about. The V&A has acquired a historic YouTube watch page, while more details have been revealed about what Lubaina Himid is presenting for the British Pavilion at the Venice Biennale 2026…

This week in London (23 February - 1 March 2026) a Tracey Emin exhibition opens at Tate Modern, with Rose Wylie’s work on show at the Royal Academy. Half Six classical music returns to the Barbican. The Aubrey at the Mandarin Oriental Hyde Park has a weekend brunch menu with a Japanese twist, and Old Spitalfields Market will host a one-day takeover by teenage entrepreneurs…

The British Pavilion has announced the exhibition details and title for Lubaina Himid CBE RA’s solo presentation at the 2026 Venice Biennale. The exhibition, Predicting History: Testing Translation, will showcase a major new body of work exploring the complexities of belonging and the meaning of home…

This week in London (16–22 February 2026), Ryoji Ikeda takes over the Barbican Centre with performances exploring sound and light, while FAC51 The Haçienda comes to Drumsheds for a full day of classic house and techno. New exhibitions open across the city, including Chiharu Shiota’s thread installations at the Hayward Gallery and Christine Kozlov at Raven Row…

With Six Nations 2026 starting on 5 February, London is packed with pubs, bars and restaurants showing every match…

Somerset House Studios returns with Assembly 2026, a three-day festival of experimental sound, music, and performance from 26–28 March. The event features UK premieres, live experiments, and immersive installations by artists including Jasleen Kaur, Laurel Halo & Hanne Lippard, felicita, Onyeka Igwe, Ellen Arkbro, Hannan Jones & Samir Kennedy, and DeForrest Brown, Jr…

This week brings fresh details from some of the UK’s most anticipated exhibitions and events, from Tate Modern’s Ana Mendieta retrospective and David Hockney’s presentation at Serpentine North to the British Museum’s acquisition of a £35 million Tudor pendant…

This week in London (2–8 Feb 2026) enjoy Classical Mixtape at Southbank, Arcadia at The Old Vic, Kew’s Orchid Festival, Dracula at Noël Coward Theatre, free Art After Dark, Chadwick Boseman’s Deep Azure, the Taylor Wessing Portrait Prize, and Michael Clark’s Satie Studs at the Serpentine…

SACHI has launched a limited-edition Matcha Tasting Menu in partnership with ceremonial-grade matcha specialists SAYURI, and we went along to try it…

Croydon is set to make history as the first London borough to host The National Gallery: Art On Your Doorstep, a major free outdoor exhibition bringing life-sized reproductions of world-famous paintings into public spaces…

February in London sets the tone for the year ahead, with landmark exhibitions, major theatre openings, late-night club culture and seasonal festivals taking over the city. From Kew’s 30th Orchid Festival to Tracey Emin at Tate Modern and rooftop walks at Alexandra Palace, here’s what not to miss in February 2026…

Tate Modern has announced that Tarek Atoui will create the next Hyundai Commission for the Turbine Hall. The artist and composer is known for works that explore sound as a physical and spatial experience…

Kicking off the London art calendar, LAF’s 38th edition at Islington showcased a mix of experimental newcomers and established favourites. Here are ten standout artists from London Art Fair 2026…

Discover a guide to some of the artist talks, as well as curator- and architecture-led discussions, to be on your radar in London in early 2026…

This week in London, not-to-miss events include the T.S. Eliot Prize Shortlist Readings, the final performances of David Eldridge’s End, the return of Condo London, new exhibitions, classical concerts, a film release, creative workshops, wellness sessions, and a standout food opening in Covent Garden with Dim Sum Library…

Plant-based cooking gets the Le Cordon Bleu treatment in a new series of London short courses…

January is your final opportunity to catch some of London’s most exciting and talked-about exhibitions of 2025. Spanning fashion, photography, contemporary sculpture and multimedia, a diverse range of shows are drawing to a close across the city…

As the new year begins, London’s cultural calendar quickly gathers momentum, offering a packed programme of exhibitions, festivals, performances and seasonal experiences throughout January. Here is our guide to things you can do in London in January 2026…

Condo London returns in January 2026 as a city‑wide, collaborative art programme unfolding across 50 galleries in 23 venues throughout the capital, from West London and Soho to South and East London. This initiative rethinks how contemporary art is shown and shared, inviting London galleries to host international…

The Southbank Centre has announced Classical Mixtape: A Live Takeover, a one-night-only, multi-venue event taking place in February 2026, bringing together more than 200 musicians from six orchestras across its riverside site…

This week in London features late-night Christmas shopping on Columbia Road, festive wreath-making workshops, live Brazilian jazz, mince pie cruises, theatre performances, art exhibitions, a Christmas disco, and volunteering opportunities with The Salvation Army.

Discover London’s unmissable 2026 fashion exhibitions, from over 200 pieces of the late Queen’s wardrobe at The King’s Gallery to the V&A’s showcase of Elsa Schiaparelli’s avant-garde designs and artistic collaborations…

Marking her largest UK project to date, Sedira’s work will respond to the unique architectural and historical context of the iconic Duveen Galleries, offering audiences an experience that merges the political, poetic, and personal…