Why marketplaces struggle with payments long after launch

Most online marketplaces launch with momentum. Supply and demand are matched, early traction looks promising, and revenue starts flowing. Yet beneath that surface success, marketplace payments often begin as a compromise rather than a long-term strategy. Early-stage teams typically focus on speed to market, choosing payment tools that work “well enough” for initial volumes. The cracks appear later, usually when growth accelerates and complexity follows.

This is the point where the discussion moves from fundamental checkout features to the more intricate framework supporting marketplace payment solutions. Payments now encompass more than simply gathering funds from purchasers; they include adherence, disbursements, risk management, reconciliation, and local intricacies. Many marketplaces realise too late that the payment layer they bolted on during launch can’t carry the operational weight they’ve created.

Early Payment Decisions That Don’t Scale

In the early days, marketplaces prioritized simplicity. A single payment processor, limited currencies, and manual seller payouts often feel sufficient. These choices rarely account for how quickly complexity multiplies once more sellers, regions, and use cases are added.

What starts as a lean setup quickly turns rigid. Marketplaces often struggle because initial payments for marketplace architectures weren’t built to handle growth in areas such as:

Multi-party transactions involving buyers, sellers, and the platform

Escrow-like flows where funds must be held before release

Revenue splits, commissions, and variable fee structures

By the time limitations become obvious, payment logic is already deeply embedded into the platform.

Regulatory Complexity Grows Faster Than the Marketplace

Payments don’t scale in a vacuum. Regulations evolve, and they do so unevenly across regions. What works in one country can be non-compliant or outright prohibited in another.

As marketplaces expand, compliance obligations pile up faster than engineering teams anticipate. KYC, AML, tax reporting, and licensing requirements quickly turn marketplace payment systems into a legal and operational concern, not just a technical one. Many platforms underestimate how much internal time is spent reacting to regulatory changes instead of building a product.

This is also where centralized solutions can quietly add value. Teams that have observed platforms like PayDo over time often note how regulatory abstractions reduce friction—not because the rules disappear, but because responsibility is more clearly structured.

Payouts Become Harder Than Payments

Collecting funds from buyers is only half the equation. Paying sellers accurately, quickly, and transparently becomes the real challenge as volume grows.

Payout complexity increases when marketplaces introduce multiple seller tiers, settlement schedules, currencies, and tax treatments. Errors here don’t just cause accounting problems, they erode seller trust.

Common payout pain points include:

Delayed settlements that affect seller cash flow

Manual reconciliation between transactions and payouts

Disputes caused by unclear fee breakdowns

At this stage, many teams realise that robust payments for marketplaces require more sophistication on the outbound side of money movement than they initially planned.

Global Expansion Exposes Payment Gaps

International growth is often a milestone moment for marketplaces and a stress test for payments. Supporting local payment methods, handling foreign exchange, and meeting regional compliance rules can expose gaps in even well-running systems.

Marketplaces that operate across borders frequently discover that their existing marketplace payment systems don’t adapt easily to local preferences. Buyers abandon carts when familiar methods aren’t available, while sellers struggle with cross-border payouts and currency conversion costs.

This is where payment infrastructure stops being invisible. The quality of the experience becomes noticeable, for better or worse.

Fraud and Chargebacks Increase With Scale

As the volume of transactions increases, the risk of fraud also escalates. Online marketplaces are particularly at risk due to the involvement of multiple entities, making it complicated to assign accountability.

Fraud protection, handling conflicts, and resolving chargebacks rarely receive top-level attention in the early stages of operations, but become imperative shortly afterward in their occurrence. Without the necessary support systems in place, fraud risks are commonly managed manually by their respective teams.

Effective fraud management typically requires:

Real-time transaction monitoring across the platform

Clear allocation of liability between buyers, sellers, and the marketplace

Integrated dispute workflows that scale with volume

Without these foundations, operational drag increases sharply.

Payment Operations Become a Hidden Cost Center

Over time, payments quietly become one of the most expensive operational areas of a marketplace. Not always in direct fees, but in headcount, tooling, and opportunity cost.

Teams hire specialists just to manage payment-related issues. Engineers spend cycles maintaining brittle integrations. Finance teams build workarounds for data that should already be clean. All of this diverts focus away from growth and product innovation.

Observers across the industry increasingly point out that payments are rarely “set and forget.” Platforms that reconsider their approach, sometimes drawing insights from integrated providers like PayDo, tend to view payments less as a feature and more as core infrastructure.

Why “Fixing Payments Later” Rarely Works

Many founders assume payments can be reworked once scale is achieved. In practice, payment flows are some of the hardest systems to replace. They are tied into onboarding, accounting, compliance, and user experience.

Retrofitting payments often means migrating live sellers, historical data, and financial workflows, all while continuing to process transactions without interruption. That complexity explains why marketplaces live with inefficiencies far longer than they should.

Planning earlier doesn’t require perfection, but it does require acknowledging that marketplace payments are foundational, not auxiliary.

Marketplaces rarely fail because demand disappears. More often, they stall because their internal systems, particularly payments, can't keep up with growth. Problems mount slowly and then suddenly become overwhelming.

Payments don't just move money; they shape trust, scalability, and long-term viability. If you are a marketplace that has faced the growing pains with respect to payments or if you're thinking through what comes next after launch, your opinion is valued. Please share experiences, lessons learned, or even open questions, and let's continue the conversation on how marketplaces can lay payment foundations that actually scale.

Le Nusa is a modern Indonesian restaurant on the Strand in London, founded by an Indonesian celebrity couple. Originally launched in Paris before expanding to Jakarta, it brings refined Indonesian cuisine to the capital in an elegant two-floor setting…

Art news to be on your radar the first week of March 2026 comes from both London and across the globe. From Kahlil Joseph’s debut feature at London’s 180 Studios and Ain Bailey’s exhibition at Camden Art Centre, to the announcement of 111 artists for the Venice Biennale…

A review of Rose Wylie: The Picture Comes First at the Royal Academy of Arts, London examines the first solo exhibition by a British female artist in its main galleries, tracing Wylie’s use of memory, wartime imagery and everyday references across large-scale paintings and intimate drawings…

The 61st International Art Exhibition of La Biennale di Venezia, titled In Minor Keys, is set to open on Saturday, 9 May 2026, and run until Sunday, 22 November 2026. Curated by the late Koyo Kouoh, who passed away in May 2025, the exhibition will be staged across Venice’s Giardini, the Arsenale…

As March arrives in London, the city begins to shake off the winter chill with plenty to see and do. Food lovers can enjoy British Pie Week, while families can mark World Book Day at Battersea Power Station. There will be major exhibition openings, including Hurvin Anderson, David Hockney and a celebration of designer Elsa Schiaparelli…Here is our guide to things to do in London in March 2026…

In a digital economy increasingly defined by automation, optimisation, and seamless systems, Xiyan Chen creates worlds that refuse to work alone. Her practice does not ask what technology can do faster or better…

This week in art, there’s plenty to get excited about. The V&A has acquired a historic YouTube watch page, while more details have been revealed about what Lubaina Himid is presenting for the British Pavilion at the Venice Biennale 2026…

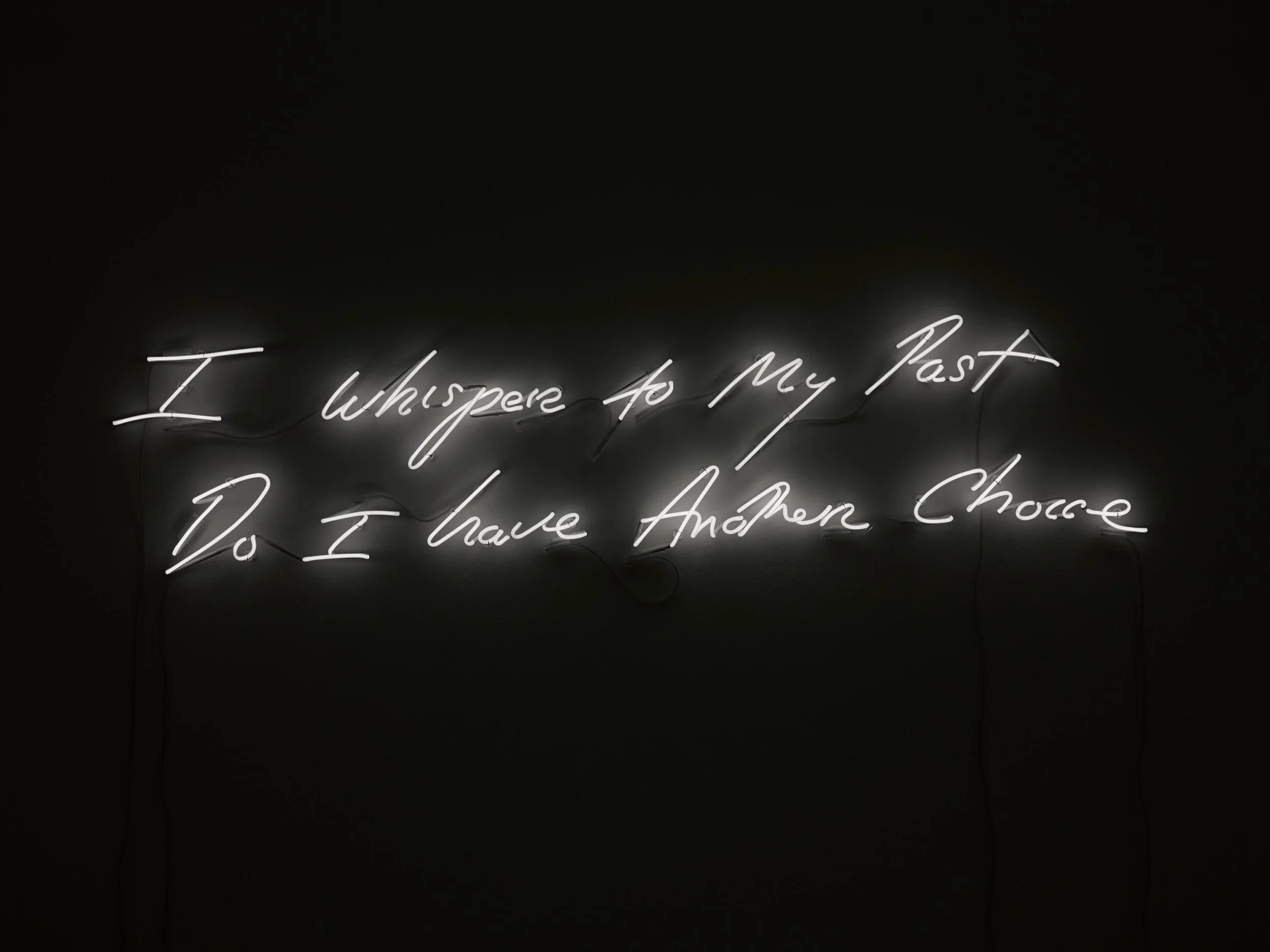

This week in London (23 February - 1 March 2026) a Tracey Emin exhibition opens at Tate Modern, with Rose Wylie’s work on show at the Royal Academy. Half Six classical music returns to the Barbican. The Aubrey at the Mandarin Oriental Hyde Park has a weekend brunch menu with a Japanese twist, and Old Spitalfields Market will host a one-day takeover by teenage entrepreneurs…

The British Pavilion has announced the exhibition details and title for Lubaina Himid CBE RA’s solo presentation at the 2026 Venice Biennale. The exhibition, Predicting History: Testing Translation, will showcase a major new body of work exploring the complexities of belonging and the meaning of home…

This week in London (16–22 February 2026), Ryoji Ikeda takes over the Barbican Centre with performances exploring sound and light, while FAC51 The Haçienda comes to Drumsheds for a full day of classic house and techno. New exhibitions open across the city, including Chiharu Shiota’s thread installations at the Hayward Gallery and Christine Kozlov at Raven Row…

With Six Nations 2026 starting on 5 February, London is packed with pubs, bars and restaurants showing every match…

Somerset House Studios returns with Assembly 2026, a three-day festival of experimental sound, music, and performance from 26–28 March. The event features UK premieres, live experiments, and immersive installations by artists including Jasleen Kaur, Laurel Halo & Hanne Lippard, felicita, Onyeka Igwe, Ellen Arkbro, Hannan Jones & Samir Kennedy, and DeForrest Brown, Jr…

This week brings fresh details from some of the UK’s most anticipated exhibitions and events, from Tate Modern’s Ana Mendieta retrospective and David Hockney’s presentation at Serpentine North to the British Museum’s acquisition of a £35 million Tudor pendant…

This week in London (2–8 Feb 2026) enjoy Classical Mixtape at Southbank, Arcadia at The Old Vic, Kew’s Orchid Festival, Dracula at Noël Coward Theatre, free Art After Dark, Chadwick Boseman’s Deep Azure, the Taylor Wessing Portrait Prize, and Michael Clark’s Satie Studs at the Serpentine…

SACHI has launched a limited-edition Matcha Tasting Menu in partnership with ceremonial-grade matcha specialists SAYURI, and we went along to try it…

Croydon is set to make history as the first London borough to host The National Gallery: Art On Your Doorstep, a major free outdoor exhibition bringing life-sized reproductions of world-famous paintings into public spaces…

February in London sets the tone for the year ahead, with landmark exhibitions, major theatre openings, late-night club culture and seasonal festivals taking over the city. From Kew’s 30th Orchid Festival to Tracey Emin at Tate Modern and rooftop walks at Alexandra Palace, here’s what not to miss in February 2026…

Tate Modern has announced that Tarek Atoui will create the next Hyundai Commission for the Turbine Hall. The artist and composer is known for works that explore sound as a physical and spatial experience…

Kicking off the London art calendar, LAF’s 38th edition at Islington showcased a mix of experimental newcomers and established favourites. Here are ten standout artists from London Art Fair 2026…

Discover a guide to some of the artist talks, as well as curator- and architecture-led discussions, to be on your radar in London in early 2026…

This week in London, not-to-miss events include the T.S. Eliot Prize Shortlist Readings, the final performances of David Eldridge’s End, the return of Condo London, new exhibitions, classical concerts, a film release, creative workshops, wellness sessions, and a standout food opening in Covent Garden with Dim Sum Library…

Plant-based cooking gets the Le Cordon Bleu treatment in a new series of London short courses…

January is your final opportunity to catch some of London’s most exciting and talked-about exhibitions of 2025. Spanning fashion, photography, contemporary sculpture and multimedia, a diverse range of shows are drawing to a close across the city…

As the new year begins, London’s cultural calendar quickly gathers momentum, offering a packed programme of exhibitions, festivals, performances and seasonal experiences throughout January. Here is our guide to things you can do in London in January 2026…

Condo London returns in January 2026 as a city‑wide, collaborative art programme unfolding across 50 galleries in 23 venues throughout the capital, from West London and Soho to South and East London. This initiative rethinks how contemporary art is shown and shared, inviting London galleries to host international…

The Southbank Centre has announced Classical Mixtape: A Live Takeover, a one-night-only, multi-venue event taking place in February 2026, bringing together more than 200 musicians from six orchestras across its riverside site…

This week in London features late-night Christmas shopping on Columbia Road, festive wreath-making workshops, live Brazilian jazz, mince pie cruises, theatre performances, art exhibitions, a Christmas disco, and volunteering opportunities with The Salvation Army.

Discover London’s unmissable 2026 fashion exhibitions, from over 200 pieces of the late Queen’s wardrobe at The King’s Gallery to the V&A’s showcase of Elsa Schiaparelli’s avant-garde designs and artistic collaborations…

Marking her largest UK project to date, Sedira’s work will respond to the unique architectural and historical context of the iconic Duveen Galleries, offering audiences an experience that merges the political, poetic, and personal…